When Does the Tax Filing Window Open 2024

As we stand on the threshold of a new fiscal chapter, contemplating the daunting task of filing our taxes becomes inevitable. The specter of holiday-induced debt looms large, urging us to decipher the optimal moment to initiate this financial ritual and anticipate the much-awaited tax refund that could potentially alleviate our financial burdens. Worry not, for clarity awaits. The Internal Revenue Service (IRS) has proclaimed that the tax season of 2024 shall commence its journey on the 29th of January.

For those who choose the digital path and seamlessly file their taxes on this inaugural day without encountering any procedural hurdles, the IRS asserts its ability to expedite the refund process within a span of 21 days or less. This swift restitution is contingent on abstaining from claims related to the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit, which, by statutory constraints, cannot be disbursed prior to mid-February. An optimistic timeline suggests that most EITC/Additional CTC-related refunds could grace taxpayer bank accounts via direct deposit or debit cards by the 27th of February, possibly even earlier for those who opted for direct deposit, devoid of any filing complications.

For those eager to ensure their tax documents embark on their digital sojourn on the inaugural day, preparedness is key. Armed with all necessary tax documents, one can complete the requisite forms now, poised to electronically dispatch them on the 29th of January. Various software companies, in alignment with this temporal cadence, facilitate the electronic submission process by withholding the filings until the IRS commences its processing endeavors later in the month.

Should the assistance of a tax preparer be enlisted, one can rest assured that their return can be curated in advance, poised for submission as soon as the IRS unveils its virtual doors on the appointed day.

The IRS Free File feature, scheduled to unfurl on IRS.gov from the 12th of January, precedes the opening of the filing season. The IRS Direct File pilot, undergoing phased deployment post-final testing, is anticipated to embrace eligible taxpayers in participating states by mid-March, enhancing accessibility to this digital tax filing initiative.

For those opting for the traditional paper filing method, patience becomes paramount. The temporal lags introduced by postal deliveries, coupled with the intricate manual processes involved in opening and processing mailed returns, extend the waiting period for those expecting a refund. The IRS forewarns that the processing of paper returns could extend to four weeks or more.

In anticipation of a deluge of individual tax returns, the IRS envisions processing more than 128.7 million filings by the looming deadline of April 15. Keen individuals can track the status of their awaited refund by navigating to “Where’s My Refund?” on IRS.gov or the IRS2Go mobile app. Whether one has e-filed a tax year 2023 return, e-filed a tax year 2021 or 2022 return, or mailed a paper return, the respective waiting periods for verification are stipulated.

Embarking on the intricate calendar of the 2024 filing season, noteworthy dates beckon:

- Jan. 12: Commencement of IRS Free File.

- Jan. 16: Deadline for the fourth quarter estimated tax payments of 2023.

- Jan. 26: Income Tax Credit Awareness Day.

- Jan. 29: Inauguration of the filing season for individual tax returns.

- April 15: Deadline for filing a tax return or requesting an extension for the majority of the nation.

- April 17: Deadline for Maine and Massachusetts.

- Oct. 15: Deadline for extension filers.

As we navigate this labyrinthine fiscal landscape, armed with the knowledge of these dates and procedures, the odyssey of the 2024 tax season awaits its commencement.

Important Dates for the 2024 Tax Season

Every year, the Internal Revenue Service (IRS) announces the opening date of the tax filing window. For the 2024 tax season, the IRS has set the opening date on January 27, 2024. This means that individuals and businesses can start filing their tax returns for the 2023 tax year on this date.

It’s important to note that the tax filing window does not mean that everyone has to file their taxes on the opening day. The window simply indicates the first day when the IRS starts accepting tax returns. Taxpayers have until the tax filing deadline to submit their returns, which is typically on April 15th.

Why Does the Tax Filing Window Open on a Specific Date?

The IRS sets the opening date of the tax filing window to ensure that they have enough time to update their systems and make necessary adjustments based on any changes in tax laws. This allows them to process tax returns efficiently and accurately.

Additionally, the opening date is strategically chosen to give taxpayers enough time to gather all the necessary documents, such as W-2 forms, 1099 forms, and other income and deduction records. By setting a specific opening date, the IRS aims to provide taxpayers with a clear timeline and avoid any confusion or delays.

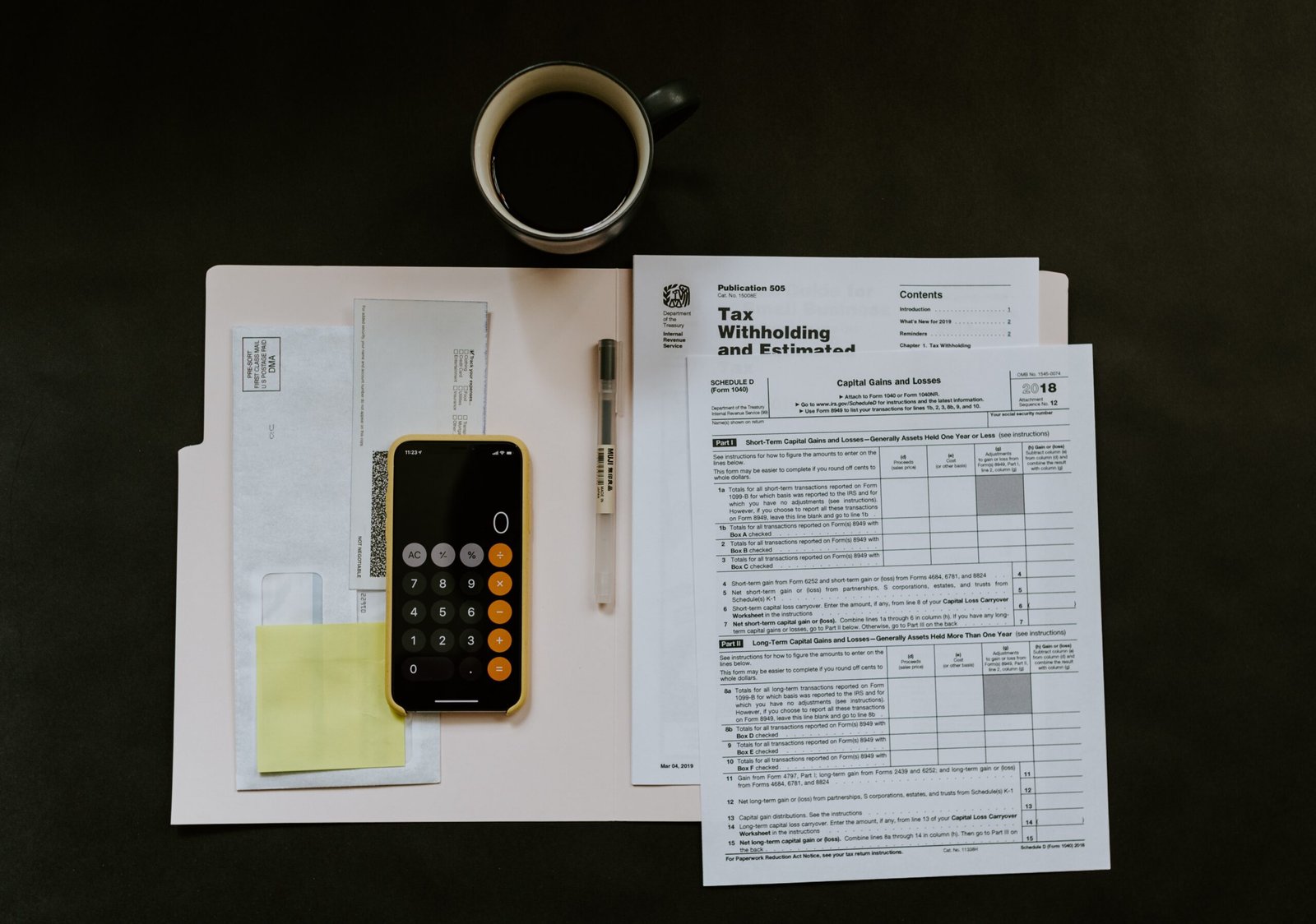

Tips for a Smooth Tax Filing Process

Preparing and filing taxes can be a daunting task for many individuals and businesses.

- Organize your documents: Gather all the necessary documents, such as income statements, receipts, and records of deductible expenses. Keep them organized and easily accessible when you start preparing your tax return.

- Stay updated on tax law changes: Tax laws can change from year to year.

- Consider e-filing: Electronic filing, or e-filing, is a convenient and secure way to submit your tax return. It reduces the chances of errors and allows for faster processing and potential refunds.

- Double-check your information: Before submitting your tax return, review all the information for accuracy.

- Seek professional help if needed: If you have a complex tax situation or are unsure about certain aspects of your tax return, consider seeking assistance from a tax professional. They can provide guidance and ensure that your taxes are filed correctly.

Conclusion

The tax filing window for the 2024 tax season opens on January 27, 2024. This marks the beginning of the period when individuals and businesses can submit their tax returns for the previous year. It’s important to stay organized, stay updated on tax law changes, and consider e-filing for a smoother tax filing process. If you have any doubts or complexities, consulting a tax professional can provide the necessary guidance and ensure compliance with tax regulations.

Click Here to Read More Articles: truereviewmagazine.com